A mining multinational will become the new owner of multiple operations.

United States-headquartered Newmont Corporation recently secured shareholder approval for its $28.8 billion Newcrest Mining takeover.

More than 96 per cent voted in support of the deal at a special meeting held on 13 October 2023.

“Newmont’s shareholders overwhelmingly voted in favor of this transformational transaction,” Newmont president and CEO Tom Palmer said in a public statement.

The deal still required Federal Court approval at the time of publication.

“All government regulatory approvals necessary for the transaction to proceed have been secured. Newmont and Newcrest anticipate the transaction closing in early November, subject to the satisfaction of customary closing conditions,” the proponent said.

New management will affect up to 6150 employees at the following operations:

- US$65 million (A$97.5M) Haverion underground mine, 450km southeast of Port Hedland

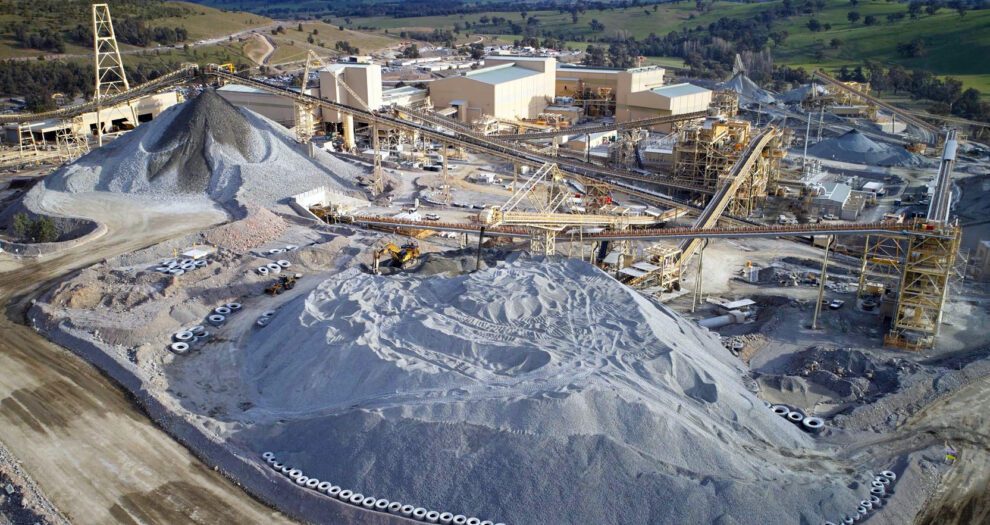

- Ridgeway underground mine, 262km west of downtown Sydney

- Cadia underground mine, 28km southwest of Orange

- Red Chris mine, 1665km northwest of Vancouver

- Brucejack mine, 950km northwest of Vancouver

- Telfer mine, 476km southeast of Port Hedland

- Wafi-Golpu mine, 313km north of Port Moresby

- Lihir PNG mine, 900km northeast of Port Moresby.

Newcrest believes the deal will deliver many benefits including a larger organisation and improved workplace safety.

Related articles

Central Qld coal mines could sell for $5B

McGrathNicol Restructuring offers Navarre Minerals Queensland’s Mt Carlton mine for sale

Resources multinational offers $29B for eight mines

Contract awarded at newly acquired mine.

Add Comment