Falling resources prices prompted employers to pause production at multiple locations.

Voluntary administrators indefinitely suspended operations at Panoramic Resources’ Savannah Nickel Project. Most of the 140 existing employees were recently instructed to stop work.

“The majority of the … staff on-site at the Savannah Nickel Project will be stood down and unfortunately made redundant, some with immediate effect,” FTI Consulting said in a public statement.

“Employees with unpaid accrued entitlements are creditors in a voluntary administration of a company with certain statutory priority entitlements ranking above the claims of unsecured creditors. Employees may also be entitled to make a claim against the Commonwealth Fair Entitlements Guarantee scheme.”

The remarks came after Panoramic engaged Treadstone Partners to urgently review the business and explore asset divestment, joint venture, recapitalisation and other funding options or partnerships during November 2023.

“Unfortunately, that process was unsuccessful in the time available and the company was therefore unable to satisfactorily progress any sales, recapitalisation or partnering options to a point where they would provide sufficient financial certainty to the company and its stakeholders,” FTI said.

The following month the proponent appointed FTI senior managing directors Daniel Woodhouse, Hayden White and Kate Warwick as joint voluntary administrators. They originally planned to continue business as usual. However, further dwindling nickel prices prompted them to suspend production altogether. Nickel spot prices had dropped nearly 42 per cent to US$16,460 (A$24,812) a tonne between January and December 2023 according to the YCharts website.

“After consultation with major creditors and key suppliers it is apparent that the prospect of achieving a near-term turnaround of operations and finances is low. Given the near-term funding requirement for continued operations, we have made the difficult decision to suspend operations while the sale/recapitalisation process progresses,” Woodhouse said in a public statement.

“Administrators, with assistance from Treadstone Resource Partners, will continue a dual track strategy to sell or recapitalise the Panoramic business. This process will continue regardless of the Savannah Nickel Project’s operating status.”

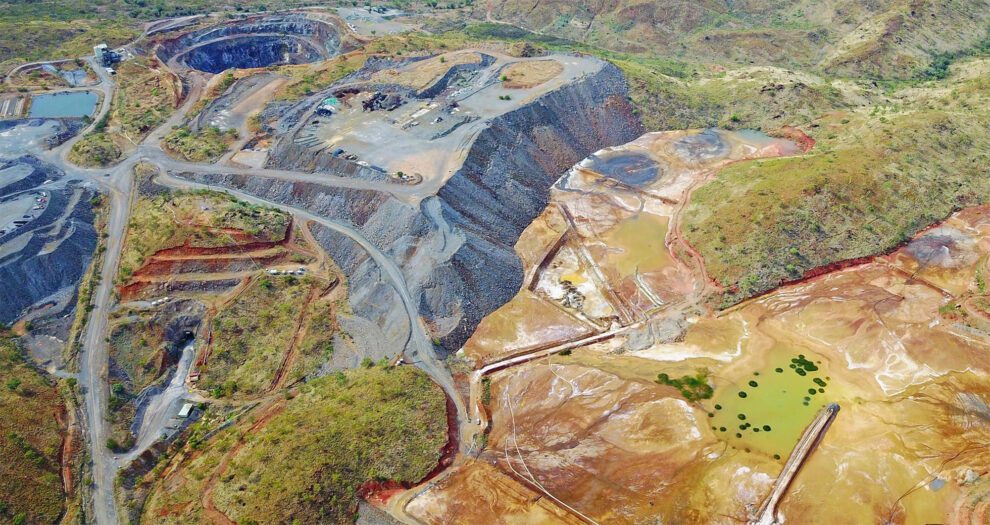

Meanwhile, First Quantum Minerals (FQM) decided to reduce operating activities at its Ravensthorpe Nickel Mine, suspend mining at the Shoemaker Levy ore body and bypass the high-pressure acid leach circuit.

Continuing to process existing ore stockpiles through the atmospheric leach circuit is promised to significantly reduce mining and processing costs.

FQM predicts nickel prices will stay “weak” for about three years.

“The decision results from the significant downturn in the nickel price experienced during 2023, combined with currently higher operating costs in Western Australia, and a requirement to improve the financial viability of the Ravensthorpe nickel operation at current nickel prices,” the proponent said.

About a third of the mine’s existing workforce will be laid off.

“Cessation of mining and associated processing activities … will reduce the company’s directly employed workforce at the site by approximately 30 per cent, with contractors to be redeployed by their employers,” FQM said.

“We will retain most of our residential and fly-in fly-out workforce, thereby supporting the communities of Hopetoun and Ravensthorpe and providing income for the region,” mine general manager Scott Whitehead added.

Add Comment